Simple Tips About How To Reduce Your Income Tax Bill

Capital losses can be used to cancel out capital gains, which are.

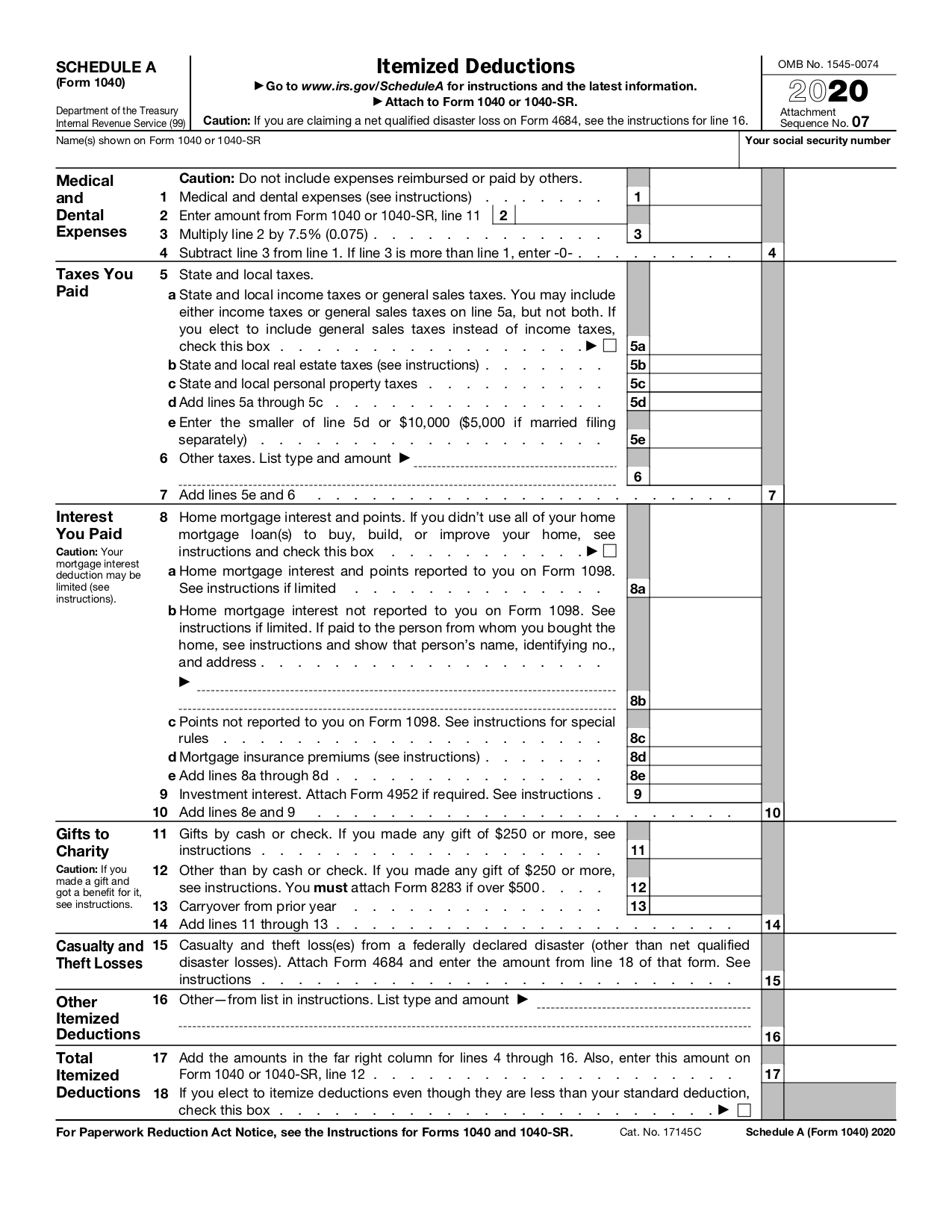

How to reduce your income tax bill. These tips can all reduce your tax bill, but will not necessarily leave you with more after tax if you would not have done these things anyway. Personal or single member llc tax. Investors may reduce their income tax bill by up to 30% of the amount they invest into qualifying companies.

Pension contributions are one of the few remaining deductions, on which income tax relief at marginal rates still applies (i.e. If you have stocks your portfolio that are underperforming, selling them at a loss could slash your tax bill. Max out your retirement contributions.

You can reclaim your personal allowance and avoid tax on your bonus by paying it into your pension. What’s more, if you paid income tax, you can reduce your income tax bill by up to 30% of the total amount you invested in the eis. In maryland, property taxes are paid to the county where the property is located.

As a result, the amount you withdraw is treated as ordinary income. S corporation and partnerships tax return. If you’re married or in a civil partnership, you can transfer.

The irs doesn’t tax what you divert directly from your paycheck into a 401 (k). You’ll need to keep good records, eg receipts and log books, and hold onto them for seven years — inland. Many other deductions are relieved at the.

Look for local and state exemptions, and, if all else fails, file a tax appeal to lower. Take advantage of tax credits. There are many tax credits available, and it is essential to claim all the benefits.