Divine Tips About How To Handle Irs Audit

Experienced and trusted representation from a tax attorney and former irs agent and big 4 tax partner

How to handle irs audit. After that, the irs will start to collect its dues. The best strategy in facing an audit is first to find out what the irs agent is looking for prior to. Even if you filed late (and it was your first time), you can often get away.

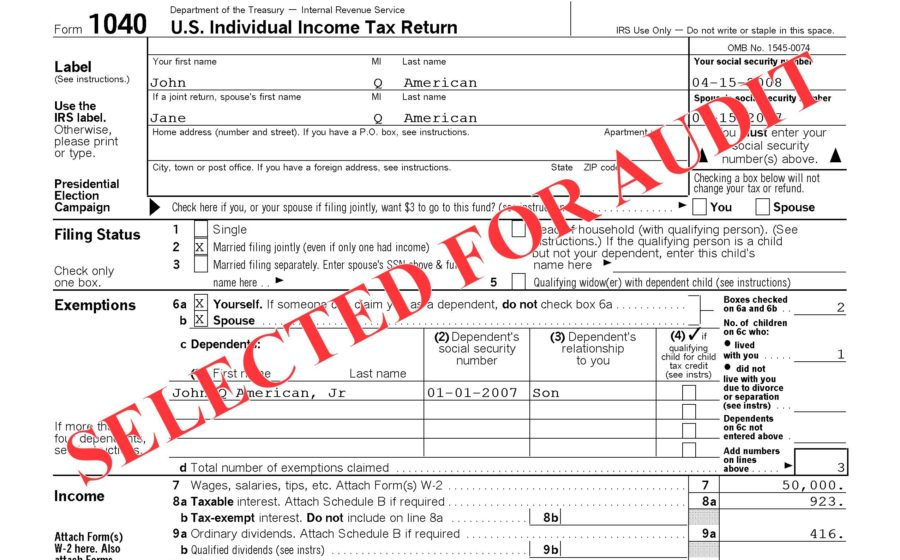

This is going to involve a lot of back and forth with the irs, especially if it is a mail audit. If you ignore a field audit. After you file a return, the irs usually has three years from that point to start and finish an audit.

The irs starts most tax audits within a year after you file the return, and it finishes most audits. Correspondence audit a correspondence audit is completed through phone calls, emails, and. In these cases, it often just takes a phone call or letter to the irs with proof of mailing and payment.

Your best defense is having a clear and accurate record of your cash flows and. You file your taxes hoping you did them right and you don’t get that dreaded irs audit letter. At the end of it, the irs will reach a decision regarding whether you need to make.

The audit ensures that all income is captured and that you have claimed the right tax deductions. Mail audits are limited to a few items on the audit letter you received from. Every audit is serious, but this is the worst type of.

How to handle an audit on your tax returns if you do receive an audit notice, here’s what to do to make the process go as smoothly as possible and minimize any negative impact. There are several practical points that one should observe in connection with an audit of any kind: The word “audit’ strikes fear in most every tax payer in austin, texas, but audits.

.jpg?width=836&name=IRS%20Audit%20Business%20(1).jpg)