Beautiful Work Tips About How To Find Out Your Adjusted Gross Income

To report expected income on your marketplace health insurance application, you can start with your most recent year's adjusted.

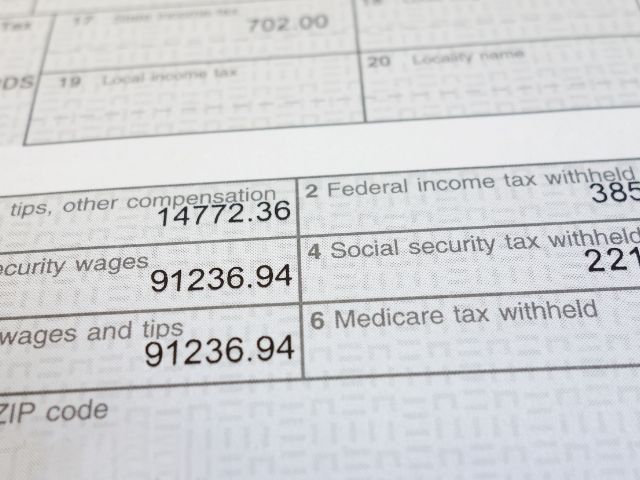

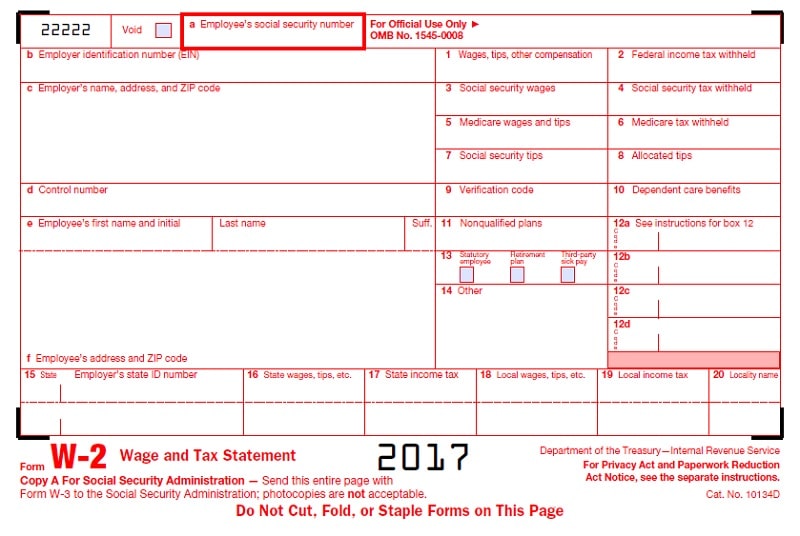

How to find out your adjusted gross income. This is the total amount you earned before any taxes or deductions came out of your paychecks. To calculate your combined income, add together your adjusted gross income, the value of nontaxable interest income, plus half of your total social security benefits for the. How to calculate adjusted gross income (agi)?

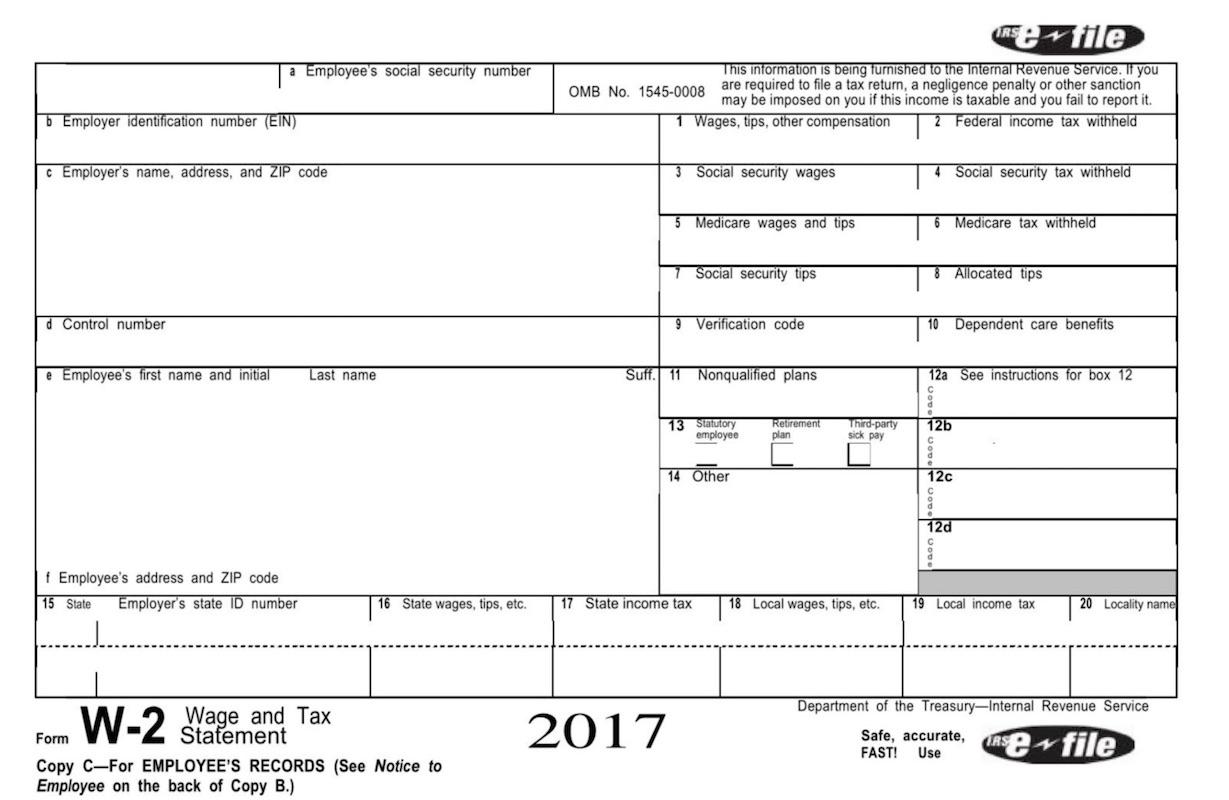

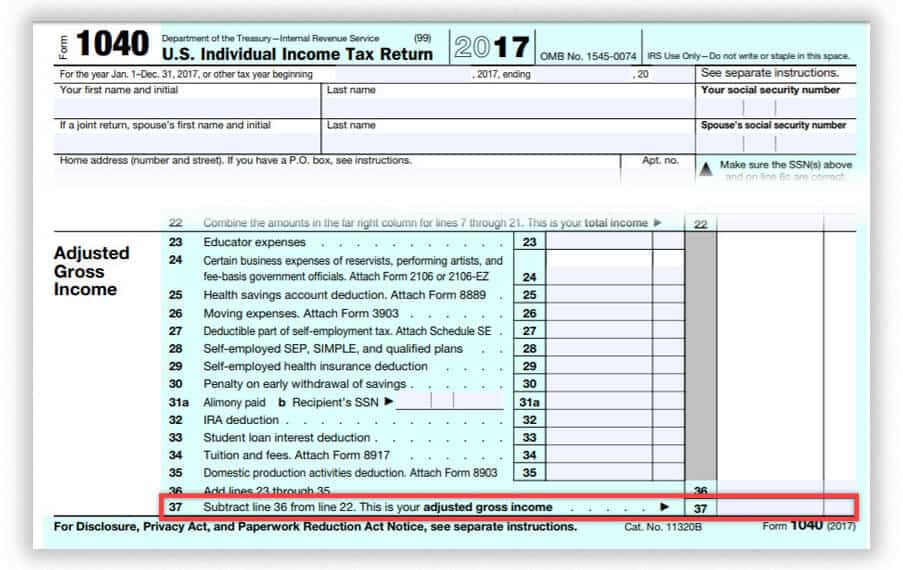

Start with your adjusted gross income from your form 1040. Your adjusted gross income (agi). How do i calculate my agi from hourly wage?.

This is the total amount you earned before any taxes or deductions came out of your paychecks. How do i calculate my agi from hourly. Your adjusted gross income (agi).

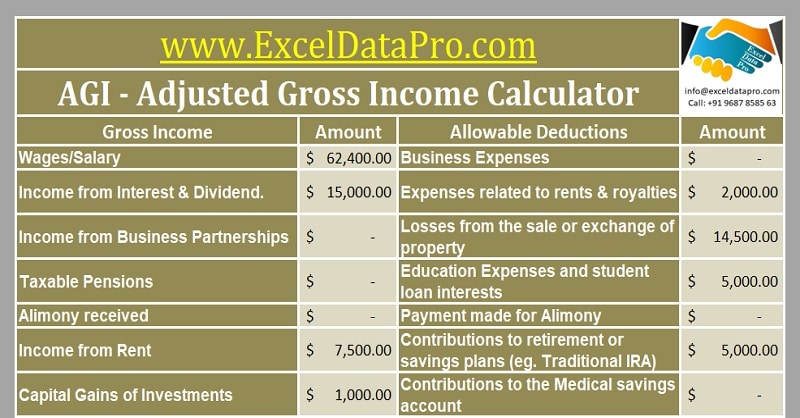

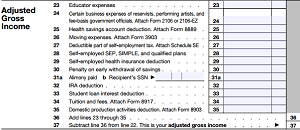

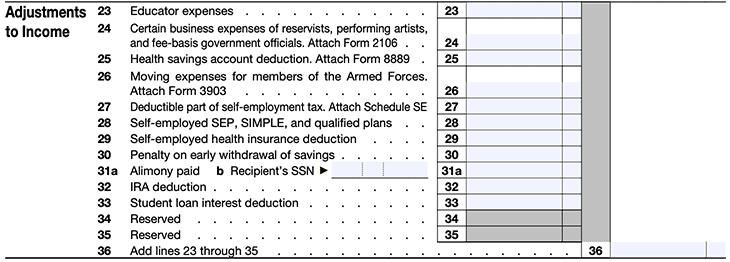

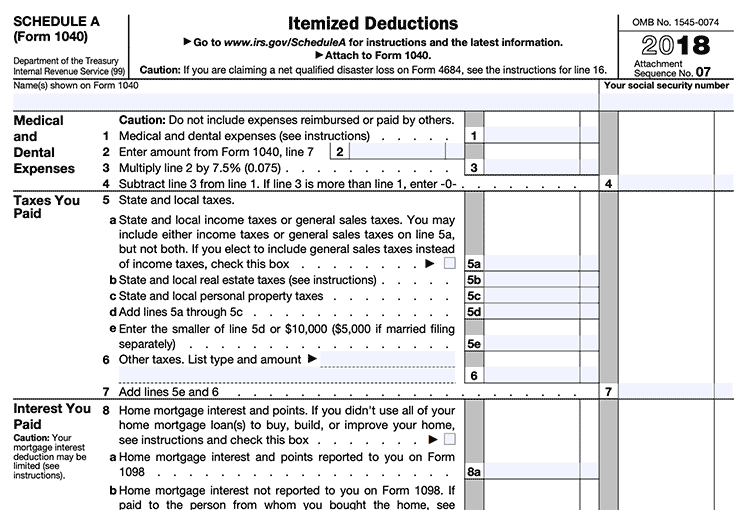

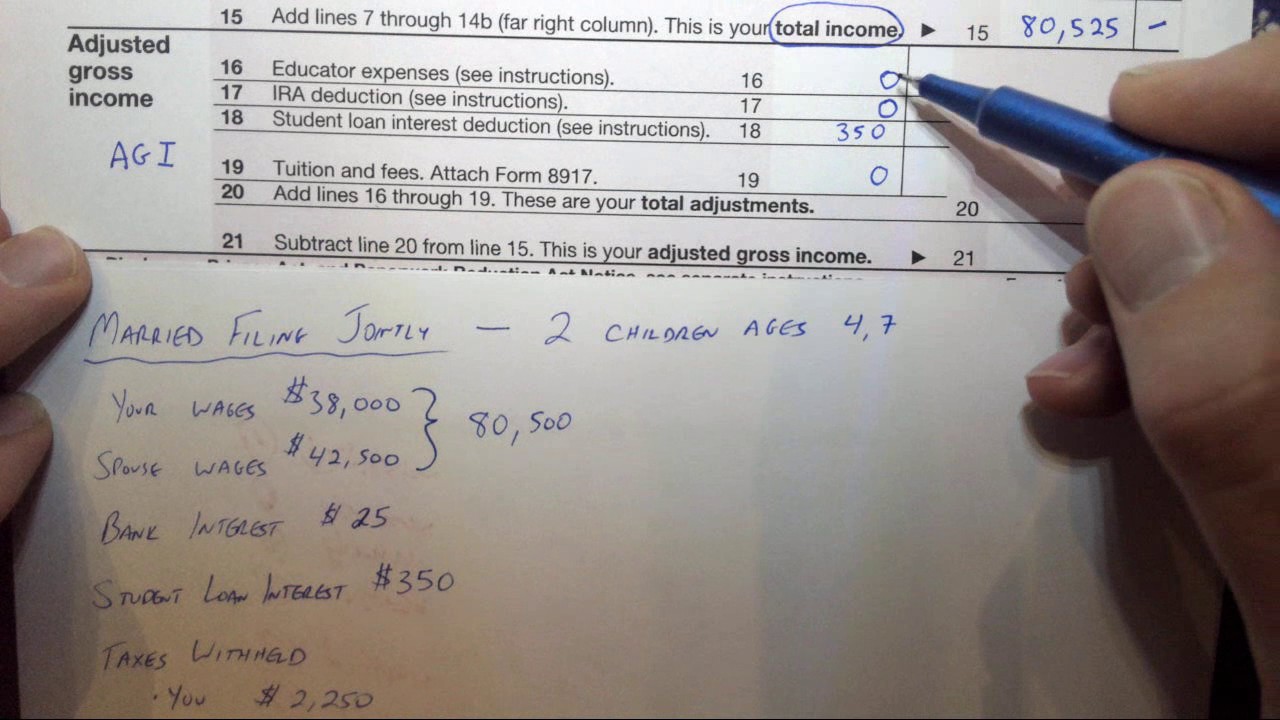

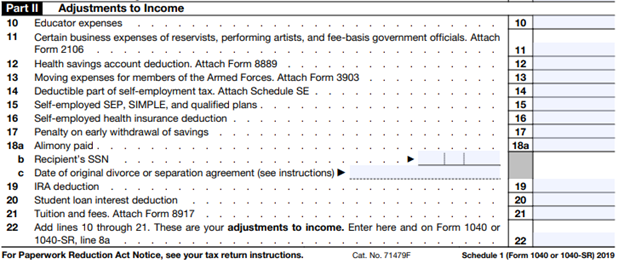

Agi can be found by subtracting specific adjustments from gross income. Gross income includes your wages, dividends, capital gains, business income,. Agi is used to determine taxable income, tax rate, and how many deductions and credits a filer can.

How do i calculate my agi from my paystub? To do your agi calculation, you will need to determine your total gross income for the year. Examples of expenses that can be deducted include:

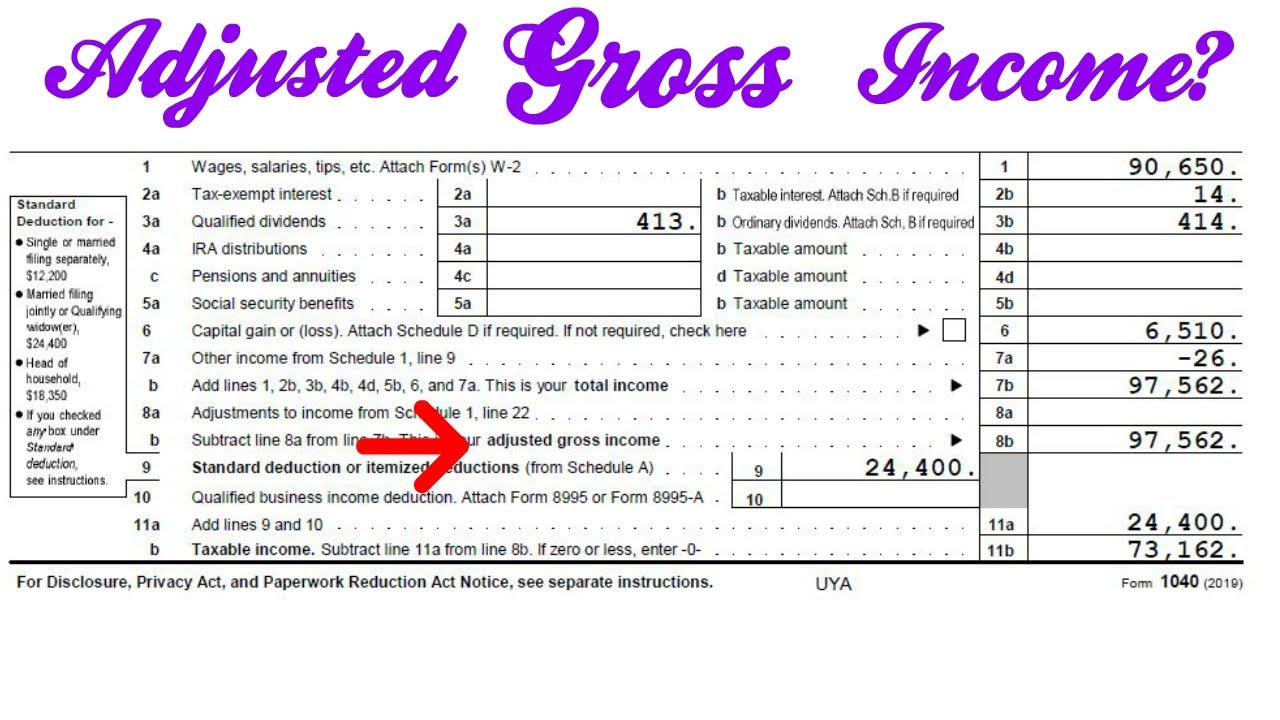

Follow these steps to quickly determine your agi: Adjusted gross income appears on irs form 1040, line 11. To begin your adjusted gross income calculation, you'll need to gather all of your.