Unique Tips About How To Avoid Paying Capital Gains Tax

:max_bytes(150000):strip_icc():gifv()/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Avoiding the capital gains tax.

How to avoid paying capital gains tax. That means that if you. You may use $3,000 of those excess net losses to reduce ordinary income from other sources each year. Hold investments for a year or more.

If you don't want to pay 15% or 20% in capital gains taxes, give the appreciated assets to someone who doesn't have to pay as high a rate. The main way to reduce your capital gains taxes is by making sure you calculate in all of the reductions that the irs allows to your overall profits. However, there are some legal methods to minimize those taxes, such as:

If you want to make a profit from the sale of your house, you will owe capital gains taxes. How to avoid capital gains tax on your property. 6 ways to avoid capital gains tax in canada 1.

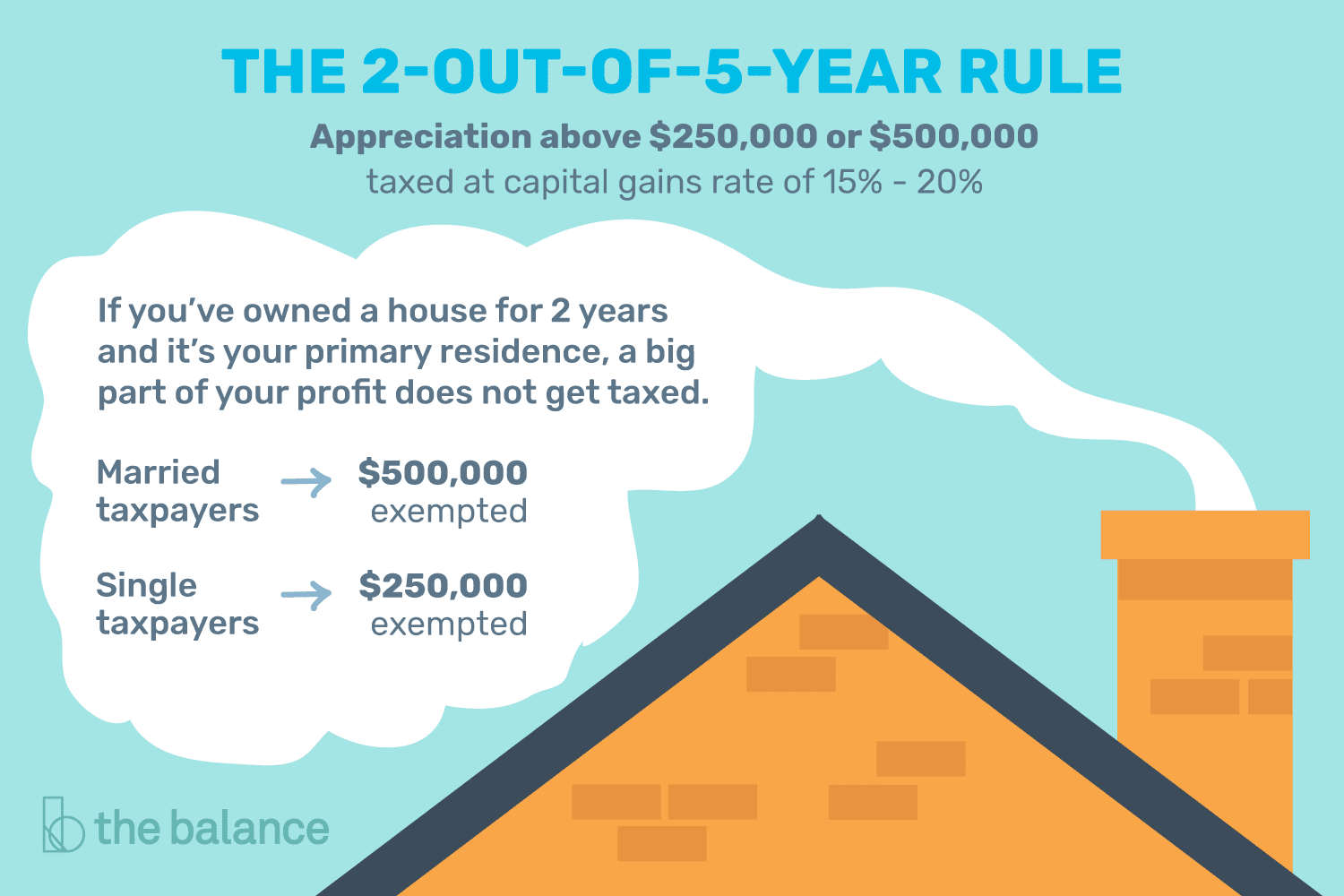

How to avoid capital gains tax on real estate sales in maryland. One way to avoid capital gains tax is to simply hold your investments forever. Once every two years, you can sell your primary residence and be exempt from paying tax on $250,000 in capital gains if you are single or $500,000 if you are married.

Tax shelters act like an umbrella that shields your investments. Do you pay capital gains if you lose money? Donate appreciated land to a charity.

After that, the capital gains. Selling the property during probate is an excellent way to avoid capital gains tax on inherited property, considering that the government waives previous cgt as unrealised gains. There are a number of concessions and exemptions when it comes to paying capital gains tax, and numerous.

![Video] Section 1031 Exchange Basics: How To Avoid Capital Gains Tax](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/Section-1031-Exchange-Basics-Video-1024x536.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)