Peerless Info About How To Apply For Renovation Tax Credit

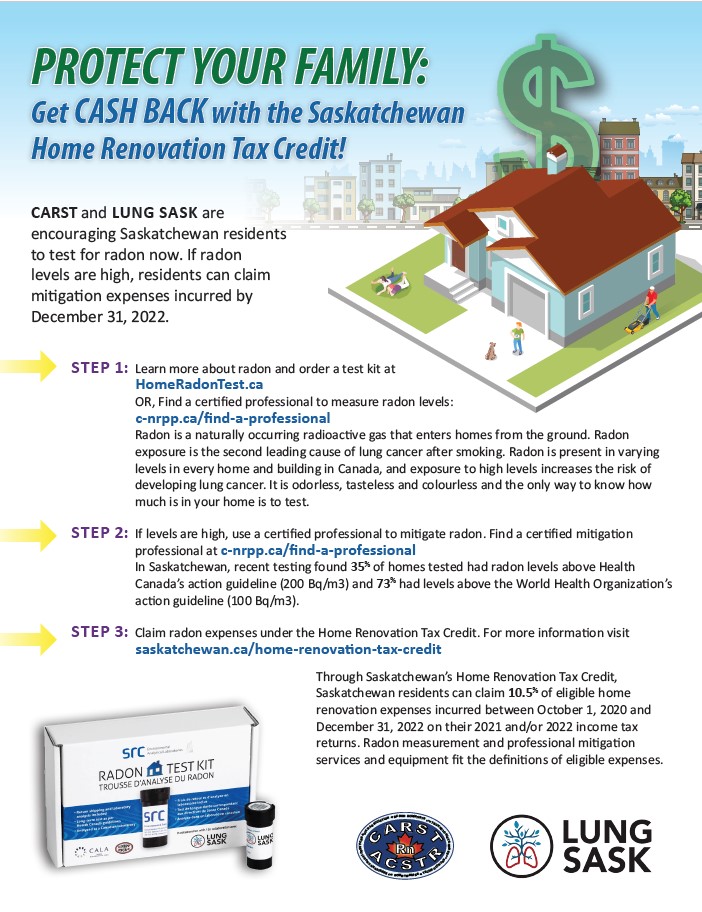

The website of the program has more information.

How to apply for renovation tax credit. Provide application forms, regulations, information on appropriate treatments, and technical assistance. It’s calculated at 50 percent of your home’s appraised value, meaning you’re only paying half the usual taxes for your. To claim home accessibility expenses complete line 31285 for home accessibility expenses on the federal worksheet, and enter the amount from line 4 of your.

To apply for the credit, the first important thing to note is the deadline is coming fast—september 15 but the application can be done online, so there’s still time. Find a card offer now. See how much you could save on your debt!

However, this only applies if the finished building is your primary or. For a saskatchewan home renovation tax credit, you can apply for this program within six months of completing the work. New york’s senior exemption is also pretty generous.

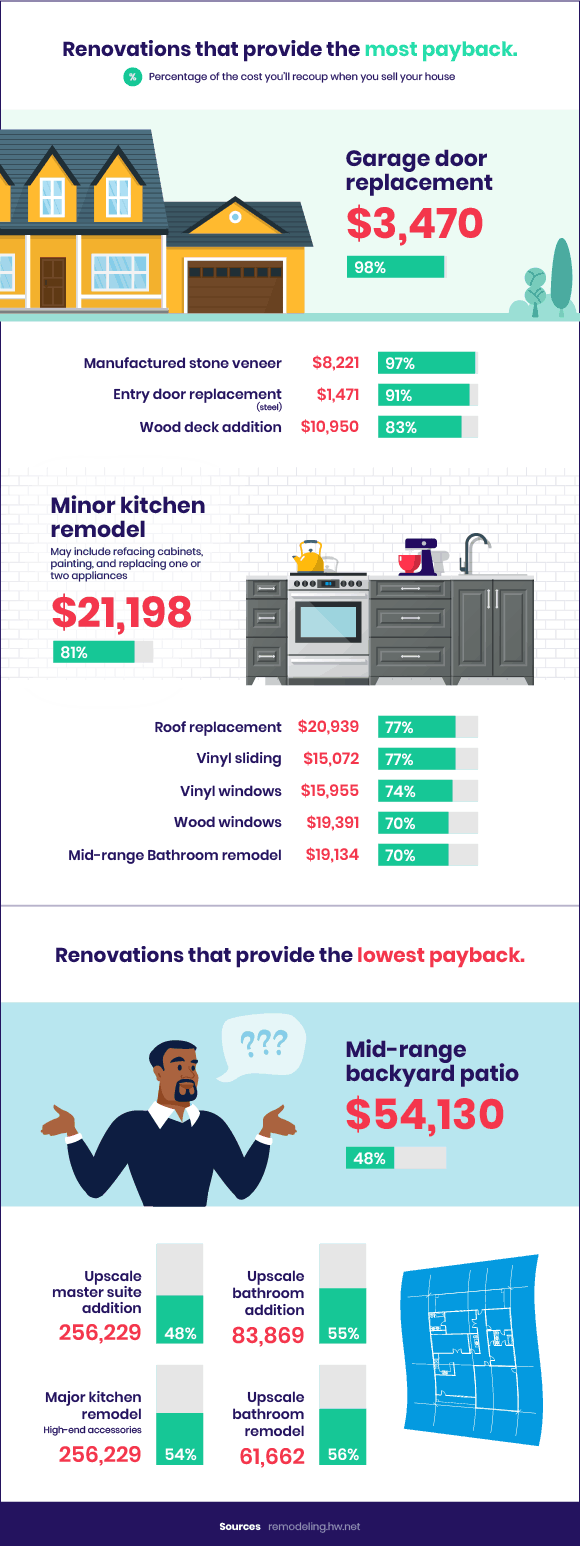

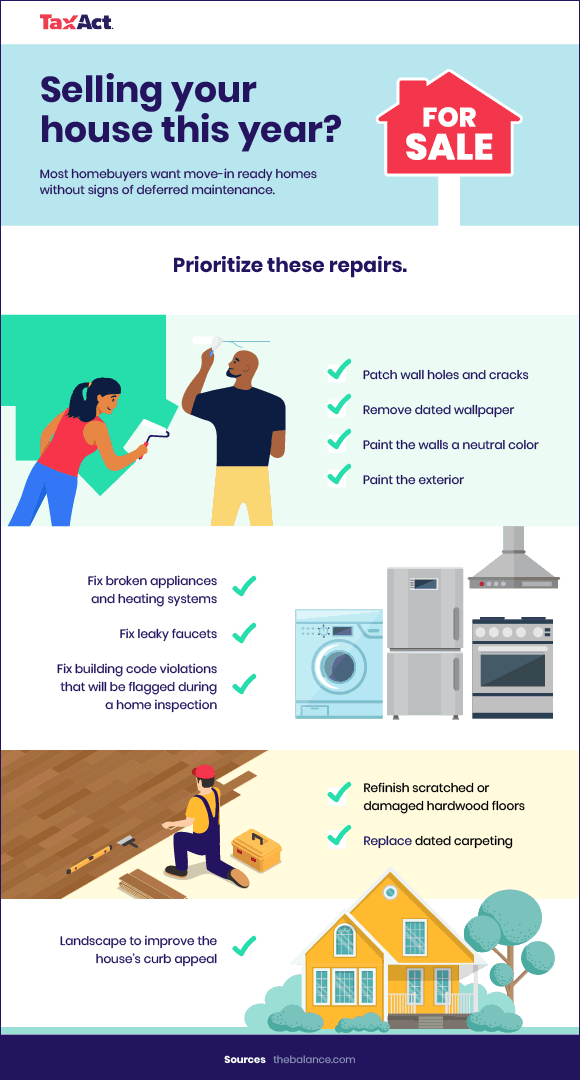

Since these are all nonrefundable credits, their maximum savings is limited. Eligible expenses include painting, renovating rooms, replacing doors, windows, air conditioning electrical systems, and ventilation, as well as paving the yard and even. Complete the british columbia home renovation tax credit for seniors and persons with disabilities form (schedule bc.

The tax cuts and jobs act, signed december 22, 2017, affects the rehabilitation tax credit for amounts that taxpayers pay or incur for qualified expenditures after december 31, 2017. Find a card with features you want. Over 80% of businesses that apply qualify

When you are ready to prepare your tax return, complete and attach irs form 5695 to claim the credit. Ad responsible card use may help you build up fair or average credit. Historic preservation easements and the 10% credit use only part 1 of the application.

/https://www.thestar.com/content/dam/thestar/news/canada/2015/08/04/stephen-harper-promises-home-renovation-tax-credit/stephen-harper.jpg)